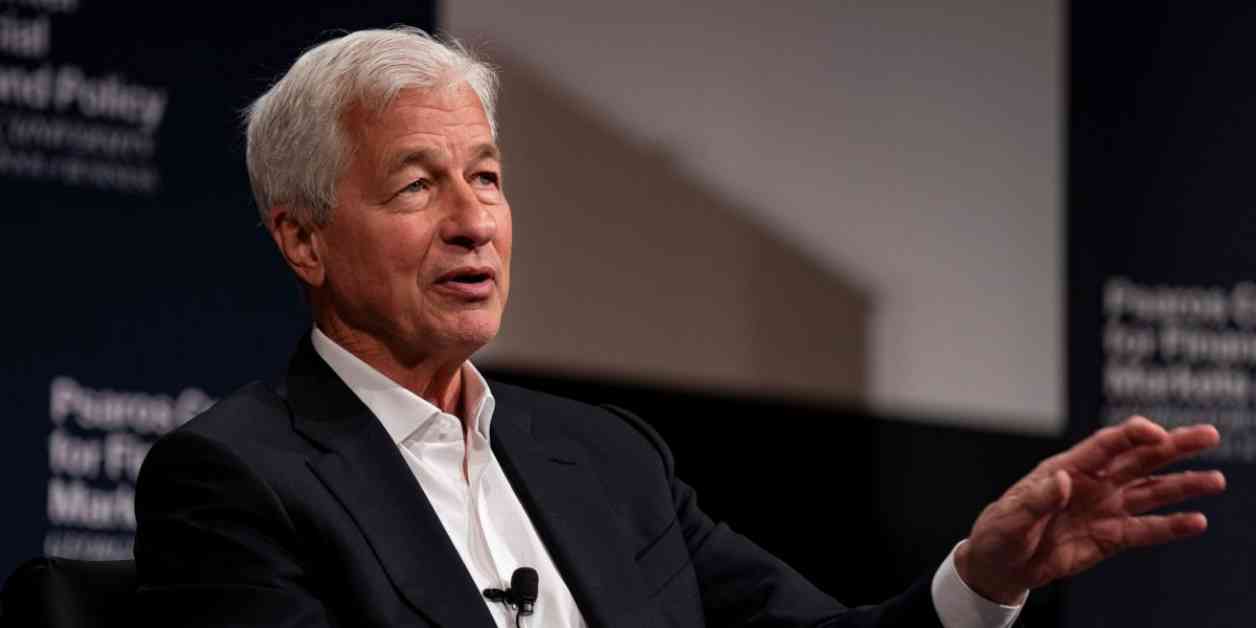

Jamie Dimon, the CEO of JPMorgan Chase, recently made headlines with his criticism of business school graduates who take private equity jobs while already employed at JPMorgan. Speaking at the 2024 Financial Markets Quality Conference at Georgetown University, Dimon expressed his views on the matter, calling it “unethical.”

Dimon’s comments have sparked a debate within the financial industry, with many questioning the ethics of such career moves. While some argue that employees have the right to pursue opportunities that align with their career goals, others believe that taking on a second job in the same industry can create conflicts of interest and compromise the integrity of the individual.

The Ethics of Dual Employment in the Financial Sector

In the fast-paced world of finance, where competition is fierce and opportunities abound, the issue of dual employment raises important ethical questions. On one hand, individuals may argue that pursuing a private equity job while working at a major bank like JPMorgan can provide valuable experience and help advance their careers. However, others may see it as a breach of loyalty and a potential conflict of interest.

Dimon’s stance on the matter reflects a broader concern within the financial sector about maintaining ethical standards and upholding the integrity of the industry. As a seasoned executive with years of experience in the field, Dimon’s words carry weight and have prompted many to reflect on their own career choices and the impact they may have on their professional reputation.

Balancing Ambition with Integrity

Finding the right balance between ambition and integrity is a challenge that many professionals face, especially in high-stakes industries like finance. While the allure of a lucrative private equity job may be tempting, it is essential to consider the ethical implications of such a move and the potential consequences for one’s career and reputation.

As individuals navigate their career paths and make decisions about their future, it is crucial to prioritize values such as honesty, loyalty, and transparency. By upholding ethical standards and acting with integrity, professionals can build a solid foundation for long-term success and earn the respect of their peers and colleagues.

In conclusion, Jamie Dimon’s criticism of business school graduates taking private equity jobs while employed at JPMorgan serves as a reminder of the importance of ethical conduct in the financial sector. As professionals strive to advance their careers and achieve their goals, it is essential to consider the broader impact of their actions and the values they uphold in their professional lives. By maintaining a strong ethical compass and acting with integrity, individuals can navigate the complex world of finance with confidence and credibility.