The U.S. spirits industry faced a challenging year in 2024, with a decline in revenue for the first time in over two decades. Despite this setback, spirits maintained their market share leadership over beer and wine for the third consecutive year. New data released by the Distilled Spirits Council revealed that while revenues fell by 1.1% to $37.2 billion, volumes actually increased by 1.1%.

Chris Swonger, the President and CEO of DISCUS, a prominent trade organization, emphasized the resilience of the spirits industry in the face of economic disruptions. Swonger acknowledged the impact of market challenges on the industry in 2024, highlighting the need for adaptability in a rapidly changing landscape.

Tequila and Mezcal Shine Amidst Adversity

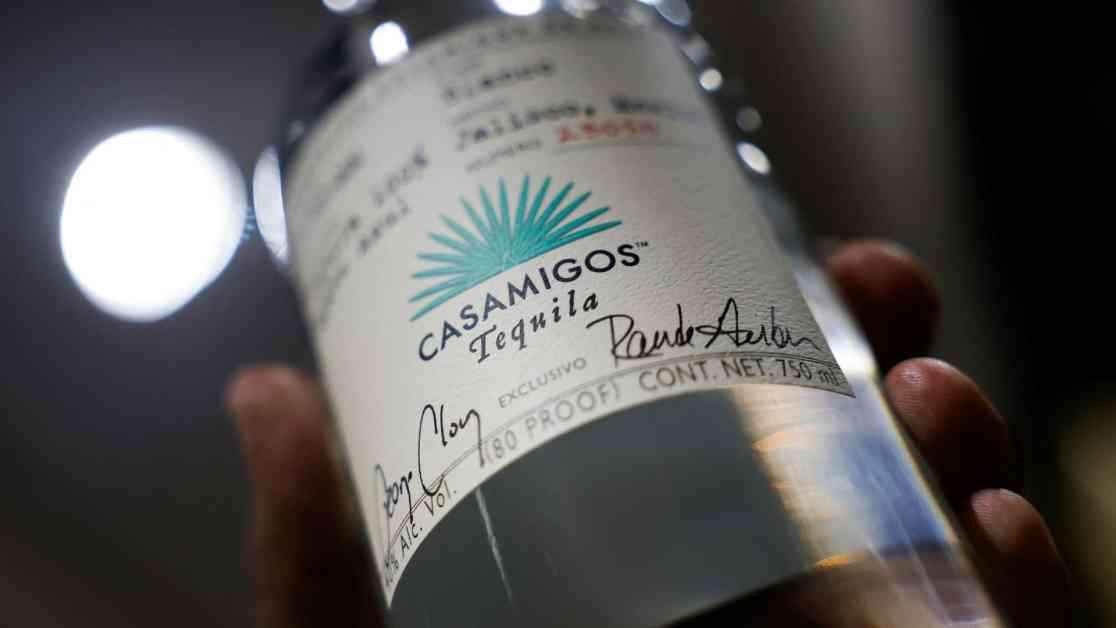

One of the standout performers in the spirits category in 2024 was tequila and mezcal, which experienced a sales growth of 2.9% to reach $6.7 billion in revenue. This marked a significant achievement, especially in the context of an overall decline in industry revenues.

The popularity of Mexican spirits, particularly tequila and mezcal, has been on the rise for years. In 2023, these products outpaced American whiskey sales for the first time, reflecting shifting consumer preferences towards these distinctive offerings.

The threat of tariffs looms large over Mexican spirits and beer, with the Trump administration considering imposing tariffs on imports from Mexico. This potential development has raised concerns among industry insiders, including Sonat Birnecker Hart, President and Founder of KOVAL Distillery in Chicago. Hart expressed dismay at the impact of tariffs on craft distillers, highlighting the devastating consequences for those who have invested in expanding into international markets.

The Impact of Economic Forces on Consumer Behavior

Swonger underscored the potential catastrophic consequences of tariffs on distillers, warning that they would exacerbate existing challenges faced by the industry. In addition to the tariff threat, higher interest rates have added pressure to the supply chain, leading wholesalers and retailers to carefully manage inventory levels.

Despite these challenges, Swonger noted that consumers continued to prioritize spirits, seeking moments of relaxation and connection with loved ones. While sales experienced a slight dip, the enduring appeal of spirits as a social lubricant remained evident in consumer choices and behaviors.

Looking Ahead: Navigating Uncertainty with Resilience

As the spirits industry navigates a landscape marked by economic uncertainty and regulatory challenges, adaptability and innovation will be key to sustaining growth and relevance. The ability to anticipate and respond to changing consumer preferences, market dynamics, and external forces will be crucial for distillers to thrive in the coming years.

In conclusion, the spirits industry’s experience in 2024 serves as a testament to its resilience and capacity for innovation in the face of adversity. By staying attuned to consumer needs, embracing change, and fostering a sense of community and connection, distillers can weather the storms of economic upheaval and emerge stronger and more vibrant than ever before.