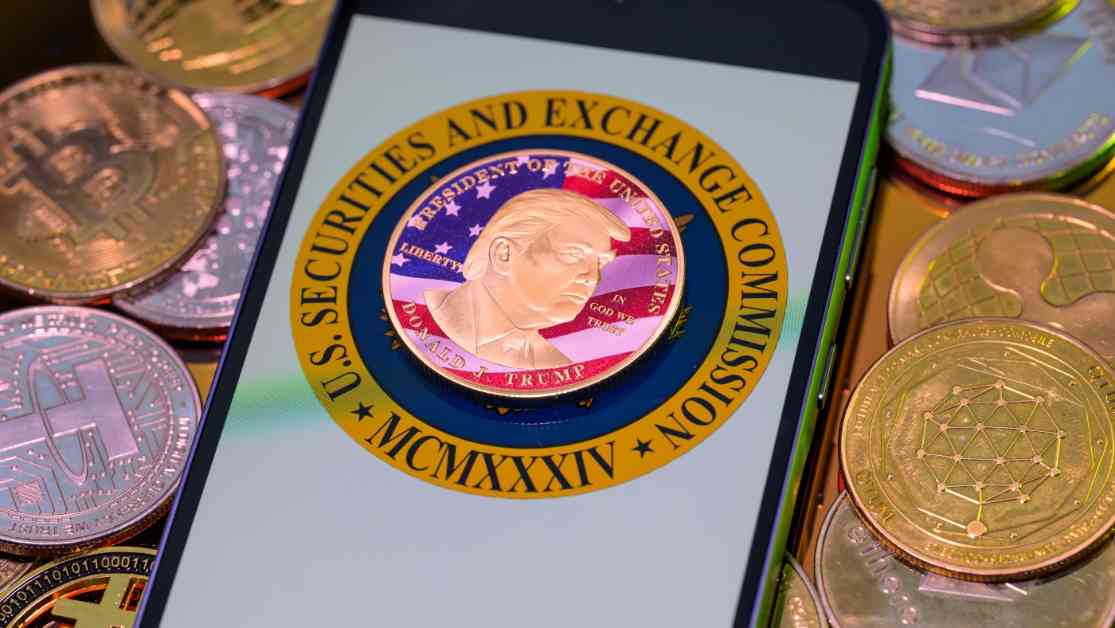

President Trump has unveiled plans for a groundbreaking initiative called the “Crypto Strategic Reserve,” signaling a pivotal moment that could revolutionize the cryptocurrency industry. This strategic move, announced via Truth Social, aims to establish the US as a major player in the world of digital assets. Trump’s vision of making the US the crypto capital of the world is coming to fruition through the creation of a reserve that will hold five prominent cryptocurrencies: bitcoin, ether, XRP, solana, and cardano.

Establishing such a reserve represents a significant shift in the US government’s approach to asset management. While the US already maintains strategic stockpiles of various resources, including military and medical equipment, the concept of a reserve involves a more active role in managing the assets. Trump’s executive order, issued in January, set the stage for evaluating the creation of a stockpile, but the move towards a reserve signifies a more hands-on approach to buying and selling cryptocurrency.

Supporters of the reserve argue that the profits generated from crypto could help alleviate the nation’s substantial debt. However, critics caution against the inherent volatility and speculative nature of cryptocurrency investments. Eswar Prasad, a Cornell University professor specializing in trade policy and digital currencies, points out that while gold, often referred to as “digital gold,” has intrinsic value, cryptocurrencies like bitcoin lack such inherent worth. If the US government plunges into the crypto market, it could become a significant player, influencing the value and dynamics of the assets.

The prospect of a reserve has sparked a surge of interest in the cryptocurrency market. Bitcoin, the pioneer of digital currencies, remains the most valuable and widely recognized. Ether, XRP, solana, and cardano, while less prominent, also hold considerable market value. The announcement of the reserve led to a noticeable uptick in the prices of these cryptocurrencies, followed by subsequent fluctuations. However, some industry experts, like Coinbase CEO Brian Armstrong, advocate for a reserve that solely centers on bitcoin, emphasizing clarity and simplicity in the investment strategy.

Despite the optimism surrounding the establishment of a crypto strategic reserve, concerns persist about the potential implications of such a move. Senator Cynthia Lummis of Wyoming introduced a bill last year proposing the acquisition of 1 million bitcoins by the federal government over a five-year period. The Bitcoin Policy Institute, echoing similar sentiments, highlighted the importance of bitcoin in ensuring financial resilience for the government. However, Prasad raises the alarm about the government’s increased influence on the crypto market, cautioning that any attempts to sell off digital assets to offset debts could trigger a drastic devaluation.

Trump’s recent foray into the crypto world marks a notable shift from his previous skepticism towards digital assets. Despite earlier criticisms of cryptocurrency as a “scam” and a potential disaster, the president now boasts several ties to the industry. From receiving substantial donations from crypto investors to launching a crypto token called $TRUMP, the president’s involvement underscores a newfound acceptance of cryptocurrencies. With personal investments in a cryptocurrency startup, World Liberty Financial, Trump and his sons are solidifying their presence in the digital currency space.

In the wake of this monumental announcement, the crypto community eagerly anticipates the unfolding impact of Trump’s Crypto Strategic Reserve. As the US ventures into uncharted territory in the realm of digital assets, the ramifications of this bold move remain to be seen. With the crypto market poised for transformation, the establishment of a reserve could herald a new era in financial landscapes, reshaping the global economy in unforeseen ways. Only time will reveal the true extent of Trump’s vision for the US as a crypto superpower.